At Tragic Media, we spend a portion of our time working with startup founders and technology executives thinking about the next era of technology. We have already written about personalization, progressive web apps, and serverless hosting.

More recently, we had a discussion about the uses of blockchain in the financial services industry. We have summarized the most relevant points from that discussion and provided them below. Feel free to read all of them or skip to the section you find most relevant.

Keep in mind, this discussion will discuss the pros and cons of the underlying blockchain technology – not specific cryptocurrencies or tokens. (We'll keep those opinions to ourselves…)

Let's jump right in.

Defining Blockchain Technology

Remember all the way back in 2017 when everyone was talking about Bitcoin? It seems like a different decade, but it was only a few years ago that you would see headlines about how people were gaining –– or losing –– thousands of dollars in a single day.

But we think that too much attention was being paid to Bitcoin (often abbreviated as BTC). Bitcoin, the cryptocurrency, is a digital token that can be used as a store of value.

However, we believe the real invention is the blockchain – the underlying network that powers BTC. We will now attempt to provide an understandable definition of blockchain, bear with us.

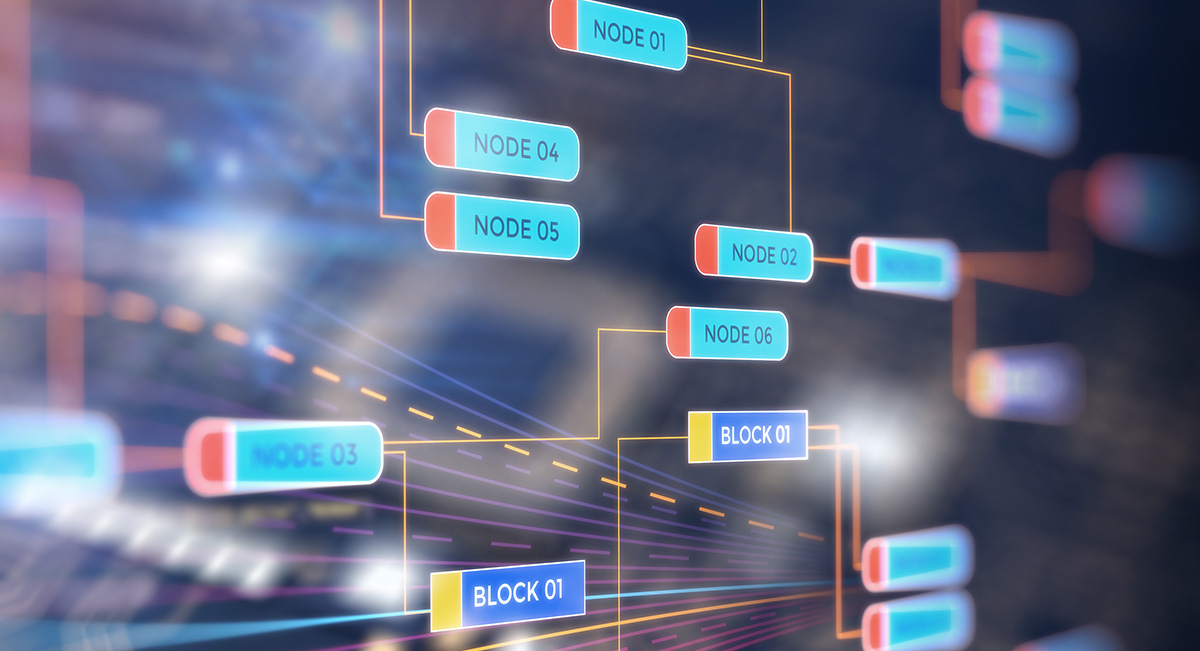

A blockchain is a network of computers (nodes) that each store the same ledger of information. This repetition ensures the credibility of the information in the ledger as there is a whole network validating "the chain".

In a blockchain, transactions are stored in an immutable list, with each transaction being encapsulated in an individual block. For example, a block could store purchase data, and everything associated with that transaction complete with payment information, time, and other metadata.

The "immutable list" refers to the chain in blockchain. When a new transaction is settled, it is added to the end of all previous transactions. This is done across the entire blockchain network, and, as a result, it's possible to have a single source of truth without relying on a central authority.

So no matter which node you connect to, you will always receive the same chain of data. This is what people mean when they say that blockchain technology is decentralized and immutable.

The Financial Services Industry Today

Unfortunately, the financial services industry today uses a lot of patchwork of technology. Some parts are modern and innovative, while others are straight from the early 1980s.

For example, bank transfers are an area that have seen little improvement in decades. John Hunter, head of global clearing at JPMorgan, said that payment processing at banks is still stuck "in the mid-80s to the mid-90s" and that errors in a bank transfer could require days to settle!

We also have our own anecdotal experience. And man, it's a long list. Whether it's the high fees, the long transaction times, the lack of detailed information, or the outdated user experience, there is much to desire.

And that's where blockchain technology could provide a step in the right direction.

The Benefits of Blockchain in Finance

Financial services firms of all types – including banks, but also money managers, loan offices, and stock market exchanges – could benefit from utilizing blockchain technology.

Modern cloud infrastructure and a blockchain network would facilitate instant transactions, low fees, better access, and increased accountability. Let's take each of these items one by one.

Transaction Speed

With blockchain technology, financial transactions – money transfers, stock purchases, and more – can happen instantaneously. You can say goodbye to the "3-5 business days" for money to clear.

For example, Stellar (XLM) and Ripple (XRP) are two popular and widely used blockchain networks. In their current implementation, they settle transactions in 4-5 seconds (source). This is not some far away technical capability; this is happening today!

In addition, these systems are available 24x7 across the globe. Things like "being closed on Sundays or holidays" can also go away.

There is no functional reason why money can't move around as freely as an entry in a database!

Transaction Costs & Fees

In addition, because blockchain networks are built from the ground up, they can leverage the scale of the internet from day one. For example, a recent Nerdwallet survey found that the median international wire transfer fee for banks was $45!

This is partly due to the fact the technology underlying international transfers. (It's old, patched together, and difficult to update.) And partly this is because banks rely on fees from transfers as a source of income.

By contrast, modern blockchain networks can settle transaction quickly, and for low fees, because they rely on their network of nodes for computation.

Put differently, a key benefit of blockchain technology is the "decentralization" – which means there is no centralized infrastructure for the platform operator to manage! Transactions are settled by the community, and the individuals who settle transactions receive a small fee for providing this service.

For Stellar, the transaction fee is roughly one-millionth of a dollar per transaction!

This dramatic reduction in fees opens up financial services to an entirely new market. And that's what we're going to discuss next.

Financial Access & Inclusion

Today, World Bank estimates that "1.7 billion adults remain unbanked" across the globe (source). These individuals do not have an account with a financial institution, like a bank, or through a mobile money provider, like Venmo and M-Pesa.

Globally, 1.7 billion adults remain unbanked.

Without access to a bank account, they lack access to build a savings, purchase goods and services online, or build credit. The unbanked and underbanked population accounts for a staggering part of the world's population.

Again, blockchain technology can extend what is currently available through mobile money providers. For free, digital wallets can be issued to people that have access to an internet-connected device like a smartphone or tablet.

Furthermore, having a digital wallet that can store multiple national and crypto currencies enables credit to be offered to hundreds of millions of people who currently do not have access.

Audits & Accountability

We would also like to clear up a misconception that has been spreading. People think that Bitcoin (BTC) is a nefarious, black market currency. And that could not be further from the truth.

Bitcoin transactions are published on a public, immutable ledger! The entire world can see when funds exchange hands on the Bitcoin network.

This is different than credit cards, whose networks are private and run by the processor (Visa, Mastercard). Moreover, the most private and difficult to track transfer is still cash! Cash is a bearer instrument: whoever holds the cash is the owner. This makes cash transactions difficult to track from the perspective of audit, tax, and compliance authorities.

As mentioned above, blockchain technology is, by definition, a single source of truth that is easy to analyze and audit. (Remember, each new block accepted is immutable. That makes auditing much easier than the convoluted paper trails of today.) In addition, granular roles and permissions can be granted to information on the blockchain.

For example, imagine inviting a tax account to view certain transactions as they prepare your annual filing or allowing a lender to get more information while performing a credit check. This access can then be revoked when their work is complete.

Conclusion

Blockchain technology is new and exciting. While cryptocurrencies and tokens get all the attention, we believe that the underlying technology – an immutable, decentralized ledger – has numerous applications for successful innovation in the financial services industry.

From opening up credit to billions that are currently unbanked to dramatically speeding up cross-border business transactions, the blockchain is powerful when correctly understood.

What questions do you have about blockchain technology? If you have questions about blockchain, or other cutting-edge technology, reach out to us. The Tragic Media team is here to discuss and help evaluate technical solutions to solve your most pressing business solutions.